Table of Contents

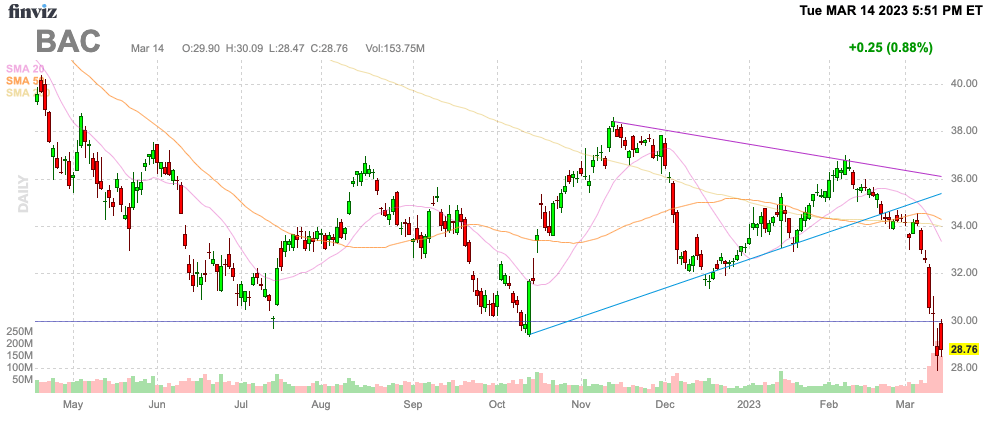

- BAC Stock Price and Chart — NYSE:BAC — TradingView

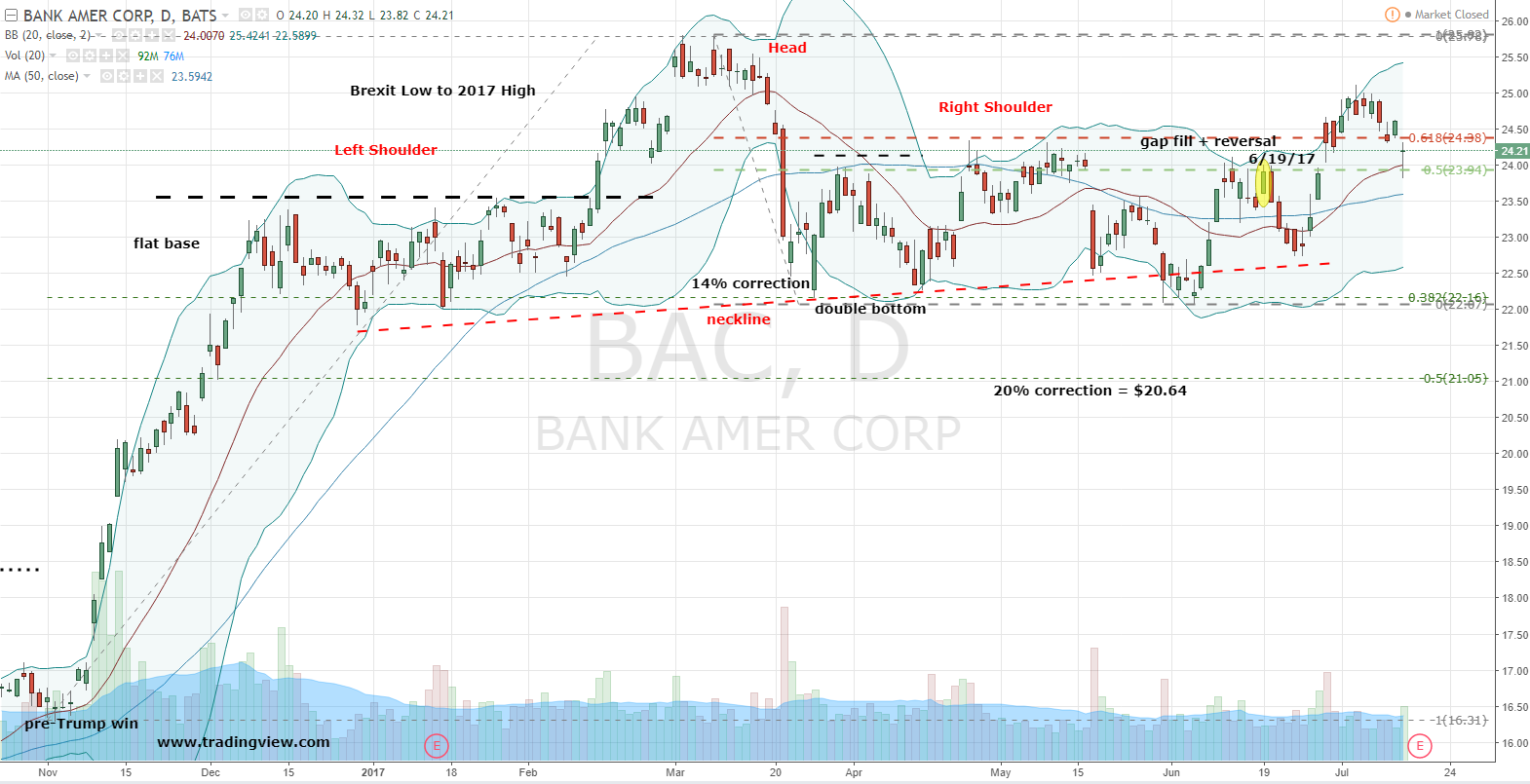

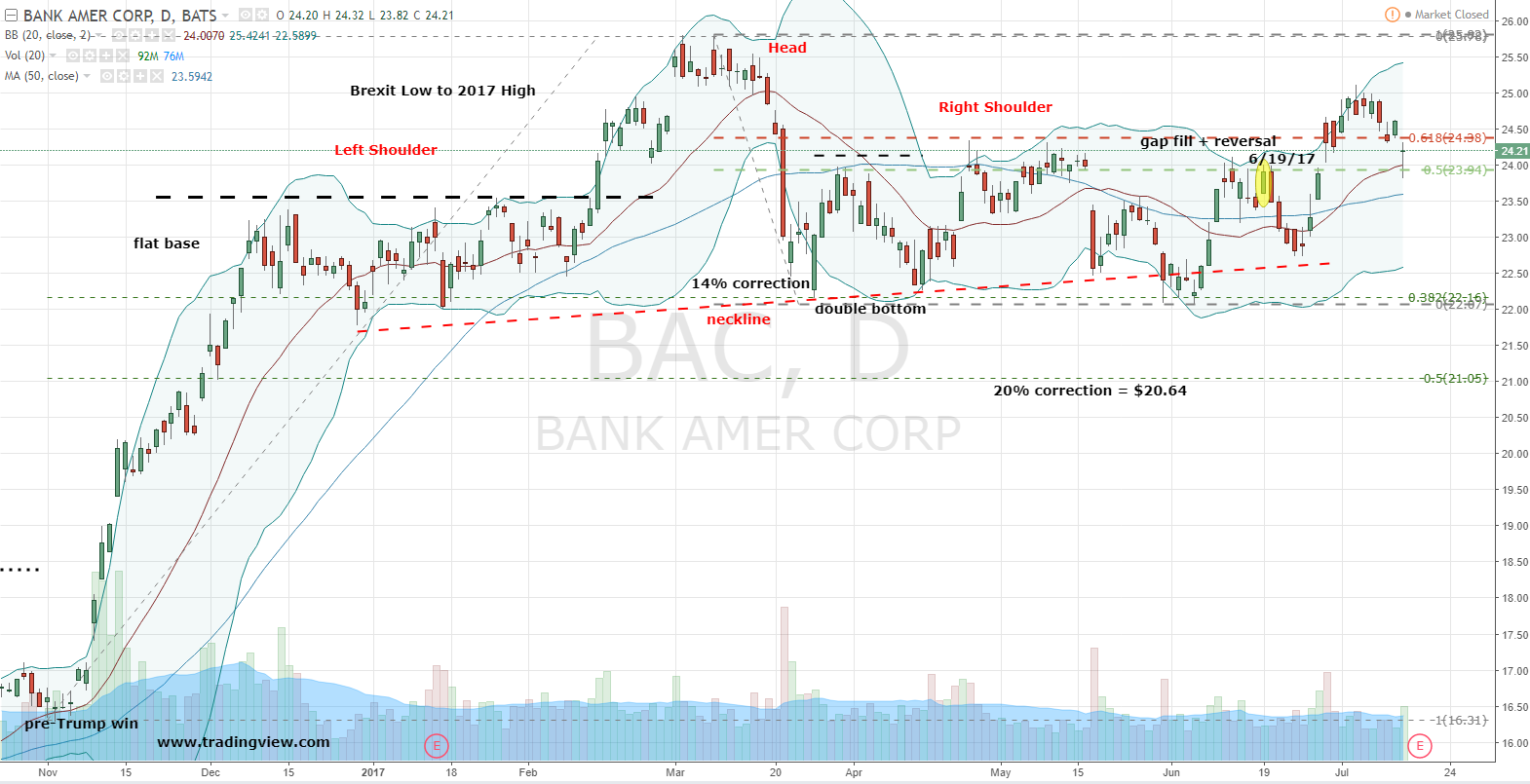

- 6/6/2017 - Bank of America (BAC) Stock Chart Review - Trendy Stock Charts

- BAC Stock Price and Chart — NYSE:BAC — TradingView — India

- Bank of America Stock: Love The Crash (NYSE:BAC) | Seeking Alpha

- How to Trade Bank of America Corp (BAC) Stock After Earnings ...

- How to Trade Bank of America Corp (BAC) Stock After Earnings ...

- BAC Stock: Buy Bank of America Stock Before the Sale Ends | InvestorPlace

- BAC Stock Price and Chart — NYSE:BAC — TradingView

- Bank of America Corp (BAC) Stock Is on the Verge of a Meltdown ...

- Here’s Why You Need to Stay Long Bank of America Corp (BAC) Stock ...

Company Overview

Bank of America Stock Price

Stock Analysis

To determine whether Bank of America stock is a good investment, let's examine some key factors: Earnings Per Share (EPS): Bank of America's EPS has consistently increased over the past few years, with a current EPS of $