Table of Contents

- Understanding Dead Cat Bounce and How to Spot It

- What Is a Dead Cat Bounce Pattern, and How Can One Trade It? | Market Pulse

- Pengertian Dead Cat Bounce Dalam Dunia Crypto

- Dead Cat Bounce Pattern - The Forex Geek

- What is a Dead Cat Bounce? Definition, Explanation, and Trading Guide

- Dead Cat Bounce: What Is It? How To Identify And Trade It?

- "Dead Cat Bounce | Funny Cate Meme | Funny Cat T-shirt | Funny Cat Mugs ...

- Dead Cat Bounce: What It Is & Means to Investors | Seeking Alpha

- Dead Cat Bounce Adalah Istilah Trading, Ini Penjelasannya!

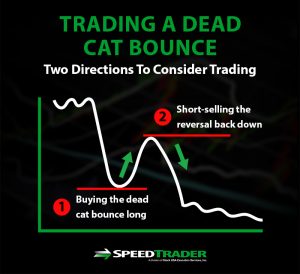

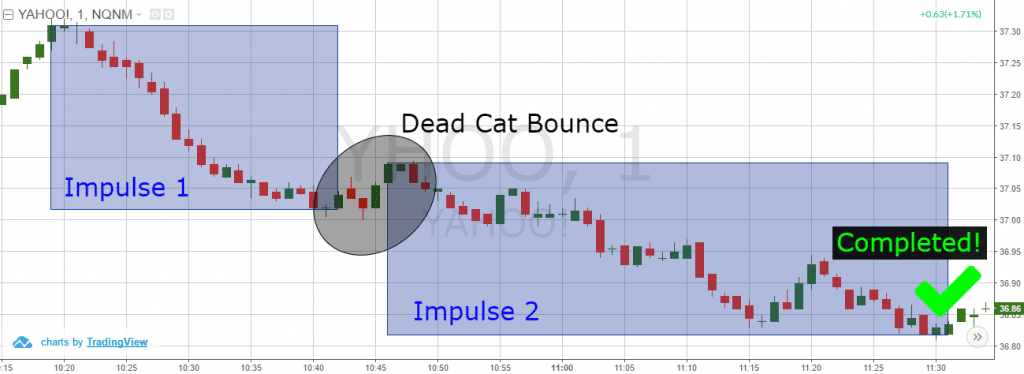

- How to Trade the Dead Cat Bounce | TradingSim

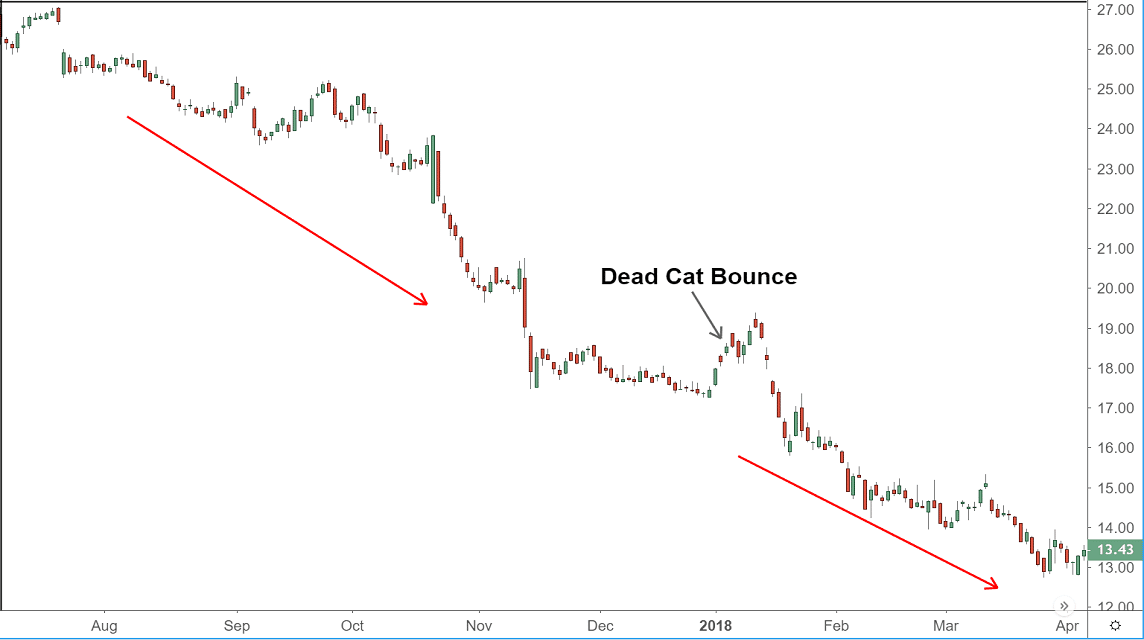

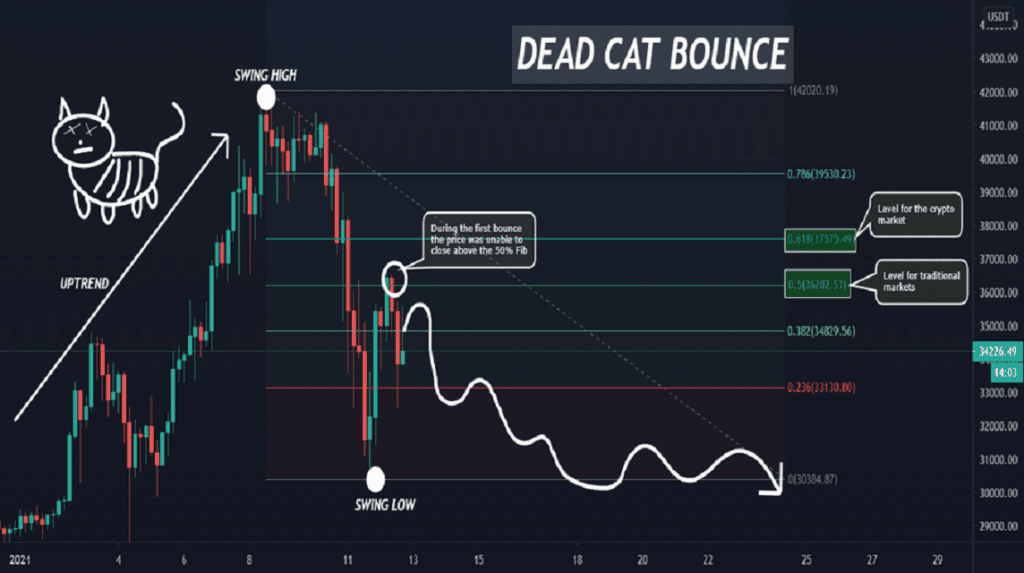

What is a Dead Cat Bounce?

Characteristics of a Dead Cat Bounce

Examples of Dead Cat Bounces

Dead cat bounces can occur in various markets and asset classes. For example: In 2008, the stock price of Lehman Brothers experienced a dead cat bounce after the company announced a major restructuring plan. However, the rebound was short-lived, and the company eventually filed for bankruptcy. In 2020, the oil price experienced a dead cat bounce after a significant decline due to the COVID-19 pandemic. However, the rebound was driven by speculative buying and not by any fundamental changes in the oil market.

How to Avoid Falling for a Dead Cat Bounce

So, how can you avoid falling for a dead cat bounce? Here are some tips: Stay informed: Stay up-to-date with market news and analysis to understand the underlying drivers of the rebound. Look for fundamental changes: Be cautious of rebounds that are not driven by significant improvements in the company's financials or industry trends. Monitor trading volume: Be wary of rebounds accompanied by low trading volume, as this can indicate a lack of conviction among investors. Take a long-term view: Avoid making investment decisions based on short-term market fluctuations, and instead focus on long-term fundamentals. In conclusion, a dead cat bounce can be a false hope for investors, offering a temporary and fleeting rebound that is not sustainable in the long term. By understanding the characteristics of a dead cat bounce and being cautious of its signs, investors can avoid falling for this trap and make more informed investment decisions. Remember to stay informed, look for fundamental changes, monitor trading volume, and take a long-term view to navigate the complex world of investing.For more information on investing and personal finance, visit Investopedia.