Table of Contents

- 10 Top REITs To Buy In 2024 | Seeking Alpha

- REIT 투자를위한 가장 중요한 지표 : 네이버 블로그

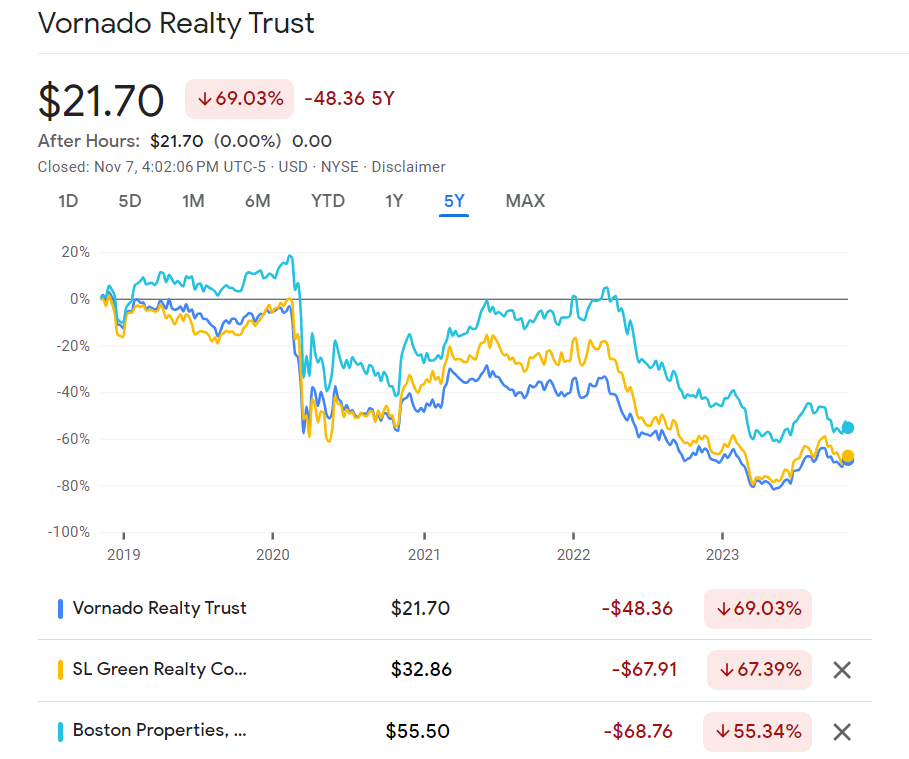

- Checking on 3 Top Office REITs | TopForeignStocks.com

- Top REITs for Yield Seekers - YouTube

- The Best REIT ETFs of 2024 - Buy Side from WSJ

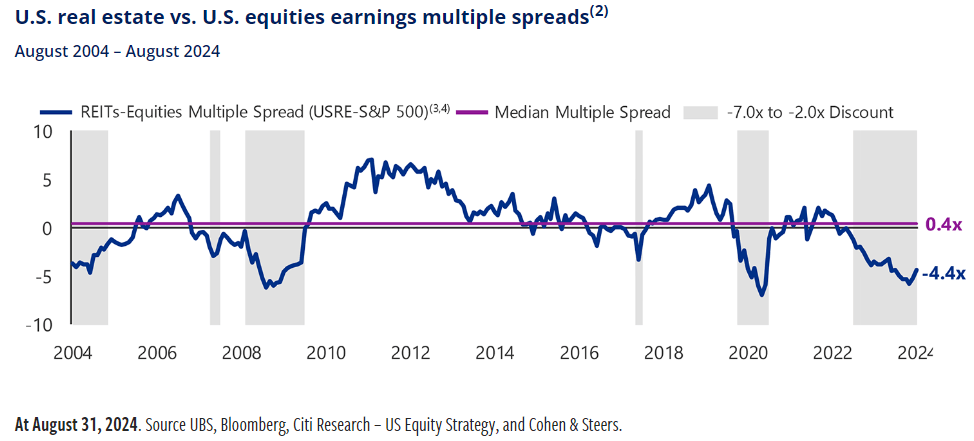

- What Are The Top REITs For 2025? | Seeking Alpha

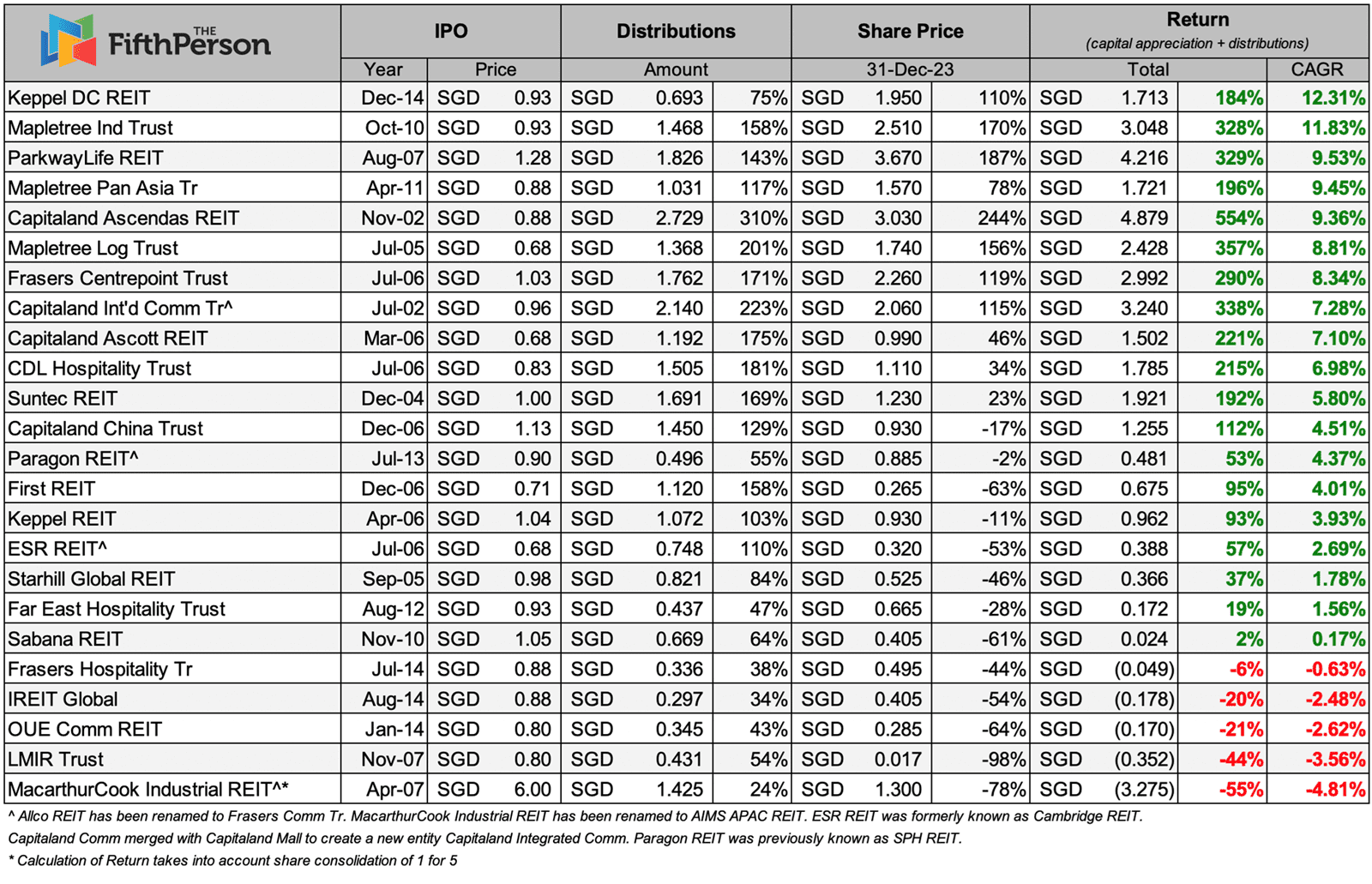

- Top 10 Singapore REITs that made you money if you invested from their ...

- Top Dividends stocks and REITs invested in April 2023 | City Dev (CDL ...

- REIT: A pathbreaking trend that boost the FOP in real estate in 2024 ...

- Ariana Grande evolution 2026 Blackfish Fan Casting on myCast

What are REITs?

Benefits of Investing in REITs