Table of Contents

- Will America’s Good News on Inflation Last? - The New York Times

- US Inflation slows down further in November - Details Inside ...

- US inflation likely cooled again last month as Fed prepares to assess ...

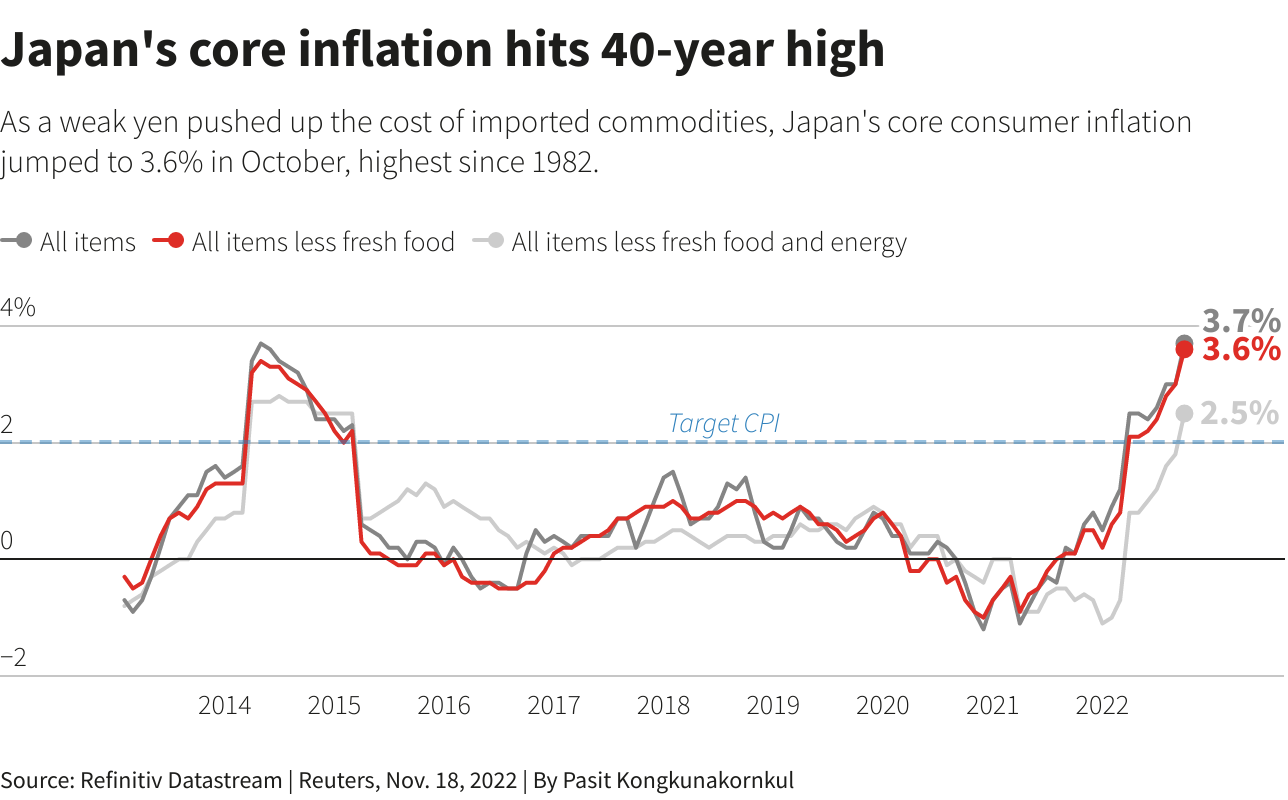

- Japan Inflation Rate July 2024 To June 2024 - Nissa Leland

- Will the U.S. inflation fall further?

- Philippine inflation rose further to 8.1% in December - YouTube

- US inflation below 5% for first time in two years

- Inflation increases to 3.2% as Americans hit with higher prices in ...

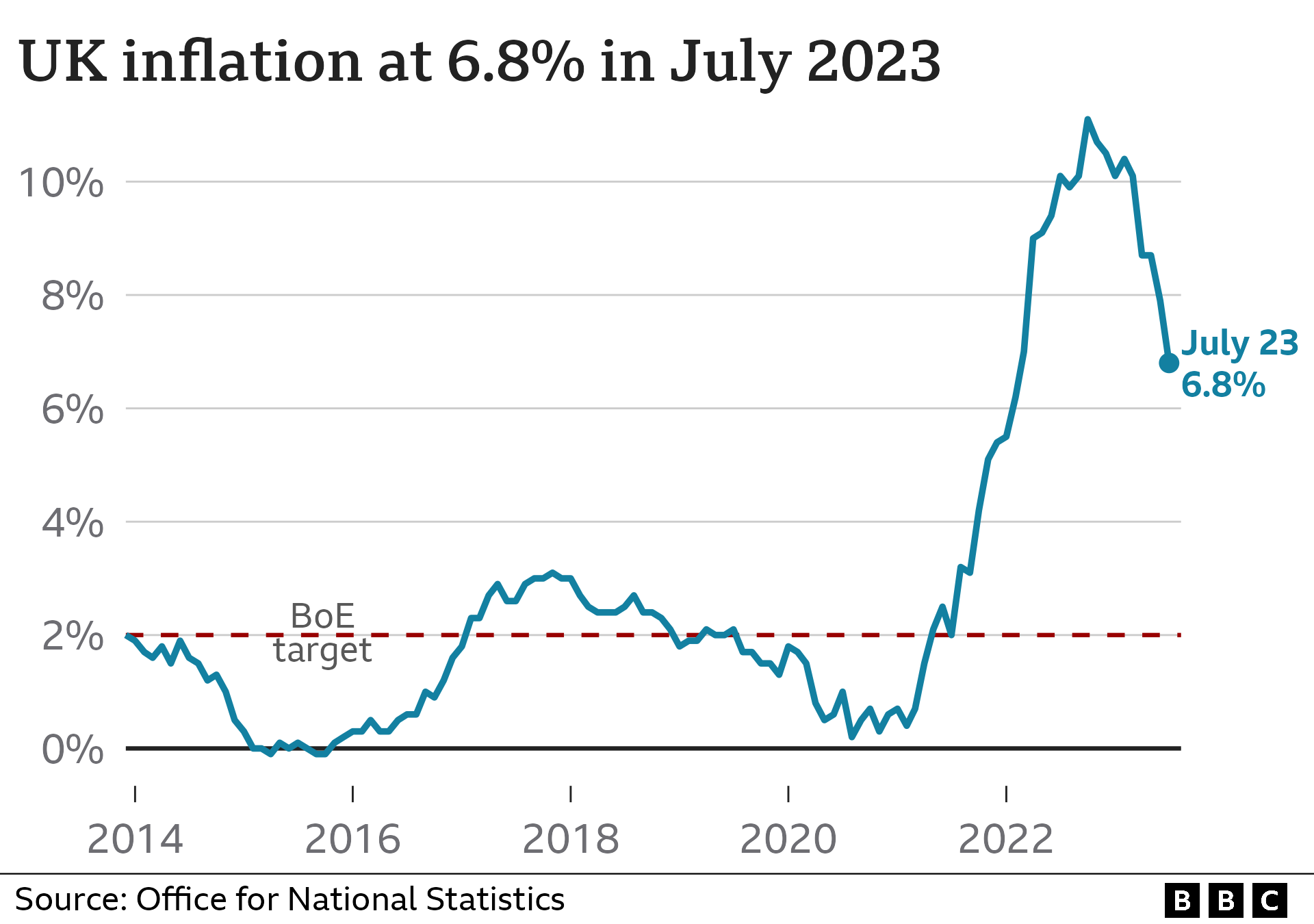

- Inflation slows to 6.8% but flights and hotels keep prices high - BBC News

- Fact Check: Joe Biden Claims Inflation Trending Down

What is Inflation, and Why Does it Matter?

Breaking Down the Numbers

Implications and Concerns

The rising inflation rate has significant implications for the economy and consumers. Higher inflation can: Erode purchasing power: As prices rise, the same amount of money can buy fewer goods and services. Reduce savings: High inflation can reduce the value of savings over time. Influence interest rates: The Federal Reserve may respond to high inflation by raising interest rates, which can impact borrowing costs and economic growth.

Expert Insights and Outlook

Economists and experts are closely watching the inflation rate, with some predicting that it may continue to rise in the coming months. The Federal Reserve has set a target inflation rate of 2%, and any significant deviations from this target can impact monetary policy decisions. As the economy continues to grow, it is essential to monitor the inflation rate and its impact on consumers and businesses. The latest CPI report serves as a reminder of the importance of understanding the complex relationships between economic indicators and their effects on our daily lives. The recent surge in the inflation rate to 2.4% in March is a significant development that warrants attention. As consumers, businesses, and policymakers, it is crucial to understand the causes and implications of inflation and to be aware of the potential effects on the economy and our personal finances. By staying informed and up-to-date on the latest economic trends and reports, we can better navigate the complexities of the economy and make informed decisions about our financial futures.Source: CBS News